How To Valuate Companies?

Stock Investing Hub ⮞ Stock Valuation ⮞ How To Valuate Companies?

5 RESOURCES

⮞ Introduction

⮞ Share Price Don’t Matter. Look At This Instead.

⮞ Why Valuations Are Important

⮞ How To Valuate Companies?

⮞ The Margin of Safety

How To Valuate Companies?

Valuation can be a complicated topic, and people come up with all sorts of valuations method.

There are so many valuation methods out there, but one of the most common one that investors used is the discounted cash flow method.

One of the most common way that people used to valuate companies is using the discounted cash flow method.

But do you know what's the biggest flaw with this method?

It is extremely subjective.

Because it depends on the growth rate that you selected.

And because of that, many beginner investors get confused and worry whether they had did the correct valuation. They then try to adjust their growth rate to try to find a more reasonable valuation.

That's why, in this section - I am going to share with you a straightforward way to valuate companies.

This is a valuation method that I have been using in my personal investment journey - and it served me well in my investment journey.

I called it the "Thermostat" method.

The "Thermostat" Method

The "Thermostat" method works on the concept of reversion to the mean.

That's right - it means that the PE ratio of these companies tend to go back to its average PE ratios as well.

(Specifically, I use a 3 years PE ratio)

Don't worry, if you are feeling lost right now, I have broken it down into a 3 steps process:

Step 1: Find the 3 years average PE ratio of the company

Step 2: Find the forward earnings of the company

Step 3: Calculate the intrinsic value of the company

Step #1: Find 3 Years Average PE Ratio

Now, remember that the reason why we want to find the average PE ratio is because of the concept of reversion to the mean.

This means that the valuation of the company will tend to go back to its average.

So how do we find the 3 years average PE ratio of the company?

The answer is by using the website: https:www.macrotrends.net

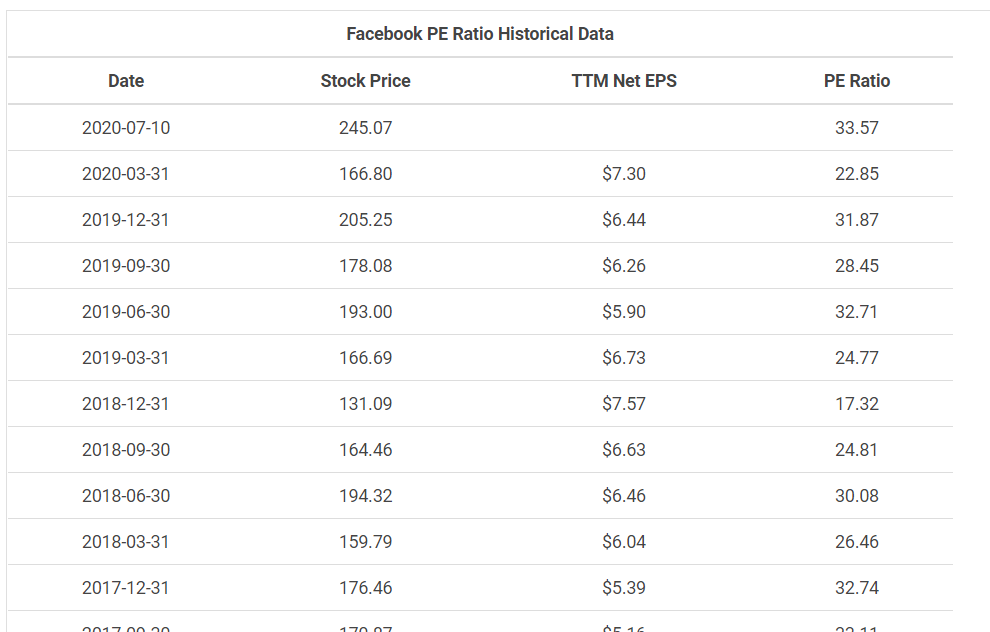

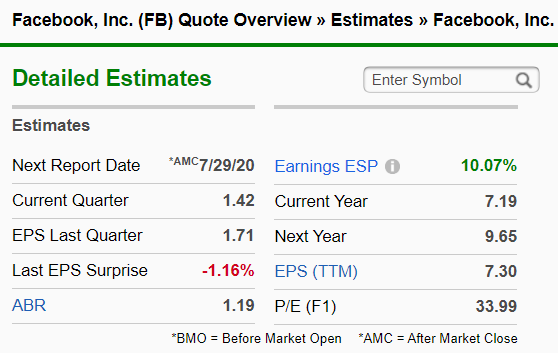

In fact, let's use Facebook as an example. The table below shows the PE ratios for the for the previous quarters.

A company report its earnings every quarter; and a year has 4 quarters.

To find the 3 years average PE ratio - I can calculate the average of the 12 quarters to find the 3 years average.

That is how you find out the 3 years average PE ratio.

Now we have the average PE ratio, we have to find the what we call the forward earnings of the company.

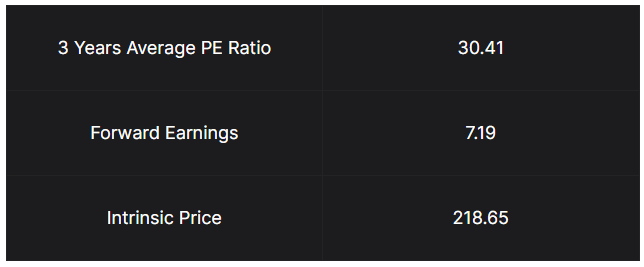

In this example, the 3 years average PE ratio would be 30.41.

Step #2: Find The Forward Earnings

Forward earnings refers to an estimate of the next period's earnings of a company.

You might be wondering, "Gin, how am I supposed to predict what the company's earnings will be in the future??"

Well, the difficult answer is this - by understanding the company, and asking yourself these questions:

Yes, these are the questions you need to answer as an investor.

Stressful, isn't it?

Don't worry - as usual, here's a quick and dirty way to do it - even if you are a complete beginner.

That is by relying on analysts.

There are analysts who are estimating future earnings as part of their profession.

One example is Zacks.com

This website collates the earnings estimates by analyst - and we can use that as a reference to use for our forward earnings.

So from the image above, you can see the following:

- The current year estimate is 7.19

- The next year estimate is 9.65

Personally, I will use the current year estimate of 7.19 - because it is much easier to estimate a closer term earnings, then next year's.

Similarly, if you asked a weather forecaster - he could predict tomorrow's weather much more accurately than if you asked him to predict next year's weather.

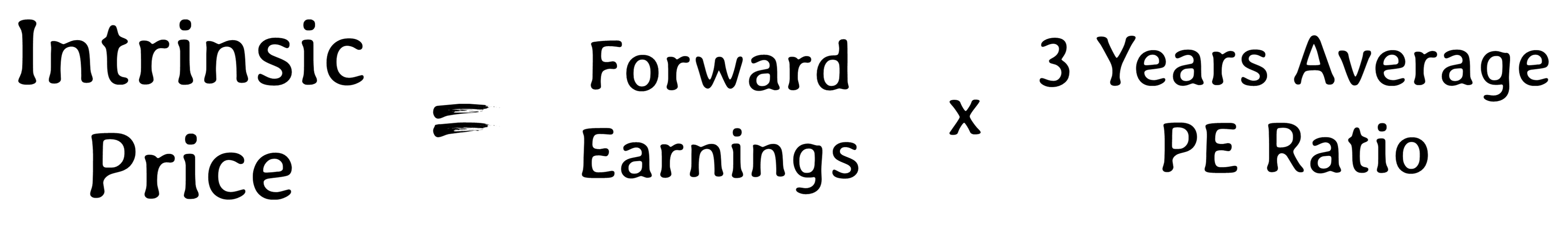

Now, we have both the average PE ratio as well as the forward earnings estimate - we have all the ingredients we need to calculate the intrinsic value using the "Thermostat" Method.

Step #3: Calculate Intrinsic Price

Congrats if you read until this point!

Here's the exciting part - how to calculate the intrinsic price of the company.

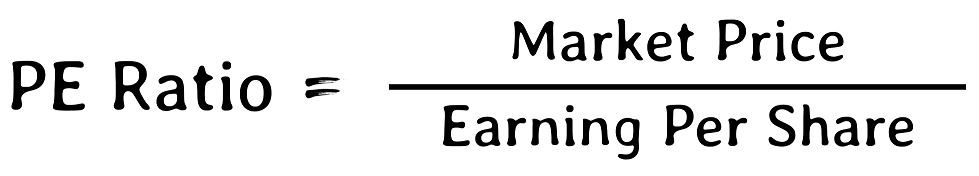

Remember the formula for PE ratio?

We can rearrange the equation to find our intrinsic price of the company.

And that is how you can calculate the intrinsic price of the company using the "Thermostat" method.

Therefore, in this example - at the point of writing, the intrinsic price of Facebook is:

This is by far, the most straightforward to do the valuation of companies, to figure out the intrinsic price of the company.

However, does that mean we buy these companies at their intrinsic price?

Well, not exactly. Our intrinsic price is not our entry price yet.

In the next section, we are going to discuss something crucial called the "Margin of Safety".